utah state solar tax credit 2020

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Utah This perk is commonly known as the ITC short for Investment Tax. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of.

Why Go Solar In Utah Utah Tax Incentives Savings

We are accepting applications for the tax credit programs listed below.

. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. 12 Credit for Increasing Research Activities in Utah.

Formally known as Renewable Energy. Ad Determine The Right Solar Power Company For You. Renewable energy systems tax credit.

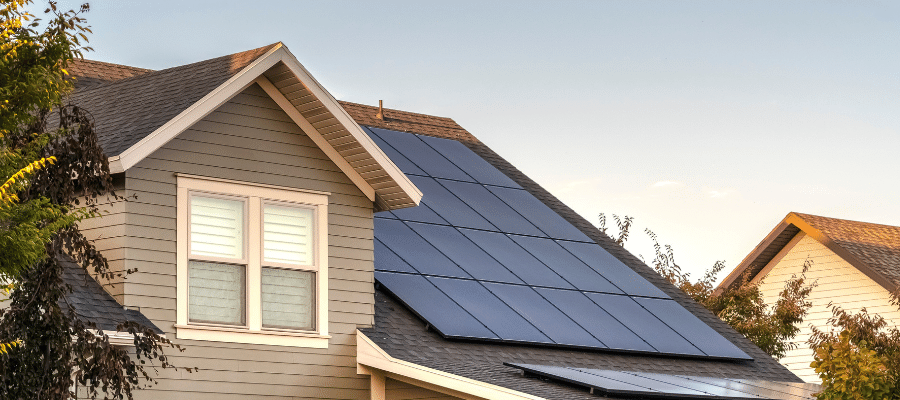

If you install a solar panel system on your home in Utah the state government will give you a credit on your next years income taxes to reduce your solar. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is. The Production Tax Credit is available for large scale solar PV wind biomass and geothermal electricity generating renewable energy projects over 660 kilowatts nameplate capacity system.

This form is provided by the Office of Energy Development if you qualify. Until December 21 2020 this tax credit covers the lesser of 25 percent or 1600 of any residential solar panel array. Utah Solar Tax Credit Households in Utah can have up to 25 of their solar installation costs covered by the Utah Solar Tax Credit.

Energy Systems Installation Tax Credit. Utah has a state tax credit for solar. Log in or click Register in the upper right corner to get started.

Utahs solar tax credit currently is frozen at 1600 but it wont be for long. 2022s Top Solar Power Companies. Under the Amount column write in 1600 a.

Read User Reviews See Our 1 Pick. 17 Credit for. 08 Low-Income Housing Credit.

Utah Code 59-10-1106 Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification. Welcome to the Utah energy tax credit portal. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research.

Local incentives for local people. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower. Read Our Company Breakdowns.

This amount decreases by 400 each year after until it expires. Utah Solar Tax Credit.

Why Go Solar In Utah Utah Tax Incentives Savings

Understanding The Utah Solar Tax Credit Ion Solar

Solar Incentives In Utah Utah Energy Hub

Dominion Offloads Stake In California Utah Solar

Why Go Solar In Utah Utah Tax Incentives Savings

Utah Solar Utah State Incentives Prices Savings

15 Things You Should Know About Utah Solar Incentives Suncoast News And Weather Sarasota Manatee Amp Charlotte